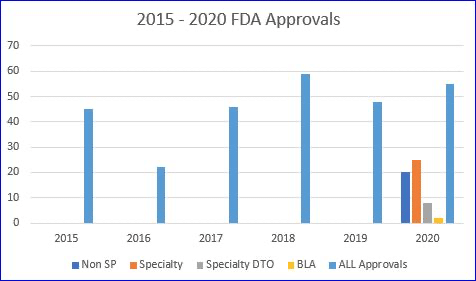

The FDA actually did a remarkable job in 2020 approving new drugs. In spite of the pandemic they managed to approve 53 novel drugs. That’s five more than 2019, when the FDA issued 48 approvals and only a bit short of the all-time record of 59 approvals in 2018.

But if you use the 2020 number of 53 you would be wrong! Huh??Yep, the real count is 56!

That’s because all the pundits that issue prior year recaps forget something…. there are also approvals for BIOLOGICS. The specialty pharmacy industry was founded on biologics, but that has shifted substantially in recent years. In 2020 there were only two BLA approvals, one for Tecartus (a gene therapy for cancer), and another for SevenFact (hemophilia).

So, are you saying, “OK wise guy, you are only up to 55, not 56!” My response would be…. ‘Hold yer horses, pardner.’If you look very closely, you’ll see that the FDA granted a new NDC for an old drug, Jelmyto, a cancer therapy reintroduced in a new formulation. We include this one in our annual count as it appears it will be launched via specialty pharmacy limited distribution.

But, what’s the big news in this otherwise totally exciting recap?We’ve created a spreadsheet for your perusal….. and one thing jumps off the page….. of the 33 specialty pharmacy NDA approvals in 2020 only 2 are available through Open Access. The rest will launch through Limited Distribution! The spreadsheet details each new specialty drug and our determination of its LD status. (See the NOTE below for an important disclaimer.)

CLICK HERE TO DOWNLOAD THE SPREADSHEET FROM THE ANTON HEALTH WEBSITE

The Impact of the LD Model

In past years specialty pharmacies were able to benefit from three things to grow their businesses. First, price increases. Second, utilization increases for existing therapies. And last, and perhaps most important, NEW PRODUCTS that usually generate larger per script revenues that boost profit margins. Additionally, new products often allow specialty pharmacies to expand into new therapeutic categories. In 2020 only a handful of the leading specialty pharmacies were the beneficiaries of launching 96% of 2020 specialty approvals via Limited Distribution (some exclusively) including therapies that we’ve classified as Limited Distribution DTO (direct-to-office as a distributor, not as a pharmacy, and most often under the medical benefit).

NOTE: We try to confirm each suspected Limited Distribution (LD) designation. In some cases, manufacturers may name the specialty pharmacy or pharmacies they have selected or simply say that the product will not be available through open access, or nothing at all. When unsure, we seek out key industry contacts to confirm if LD is in play.

Last word—– The article below is worth a quick read to learn about the most noteworthy 2020 approvals, both specialty and non-specialty.

———————————————————————————

BIGGEST NOVEL DRUG APPROVALS IN 2020

Jan. 4, 2021 — 2020 was a peculiar year for drug approvals, partly because the ongoing COVID-19 pandemic delayed many clinical trials. Another reason is because several of the highly anticipated drug approvals for the year were surprising failures, such as Novartis’ inclisiran for hyperlipidemia in adults, FibroGen’s roxadustat for anemia in chronic kidney disease, and Gilead Sciences’ filgotinib in rheumatoid arthritis. Some of them may make a comeback in 2021 or later, but they did not hit the mark for one reason or another in 2020.

On the other hand, the pandemic and the astonishing innovations of numerous pharmaceutical companies created drugs to treat COVID-19 in record time. Here’s a look at the top 10 novel drug approvals of 2020, ……………………

CLICK HERE TO ACCESS THE FULL ARTICLE