Last week the FDA approved a new ORAL Oncology therapy, Fotivda (tivozanib) from Aveo Oncology, for the treatment of adult patients with relapsed or refractory advanced renal cell carcinoma.

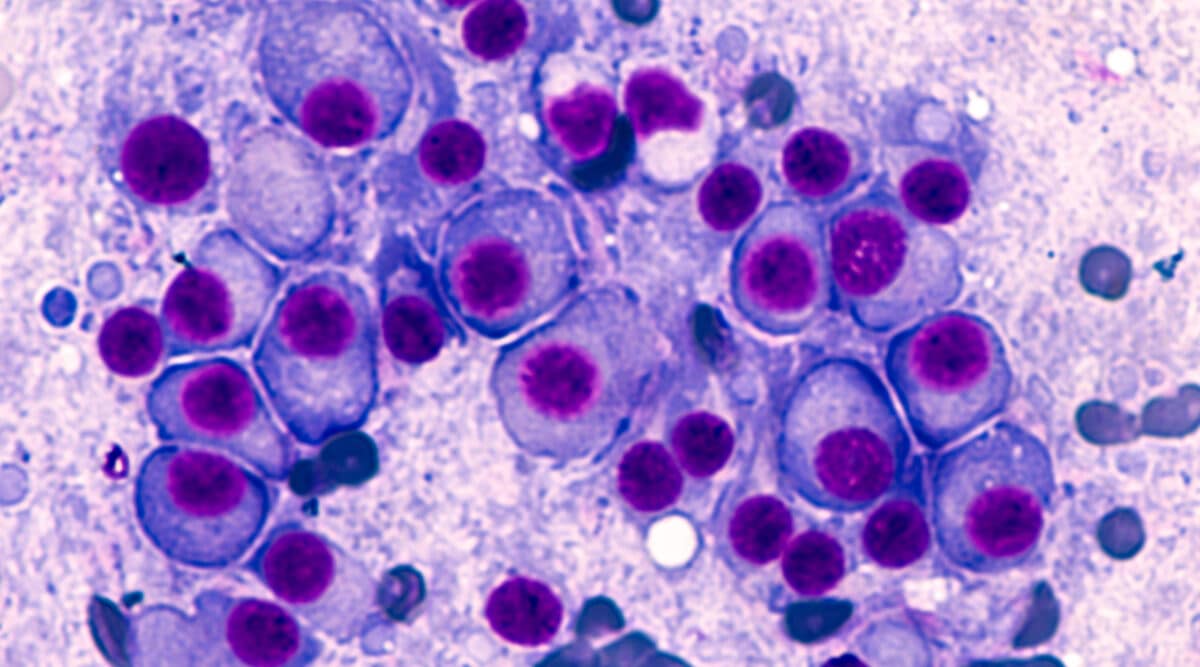

Renal cell carcinoma (RCC) is the most common type of kidney cancer and is among the ten most common cancers in both men and women. Approximately 74,000 new cases of kidney cancer are diagnosed with about 15,000 fatalities annually. The five-year survival rate is only 13%.

Fotivda will launch with a wholesale acquisition price of $24,150 per month. This compares with the $20,760 cost of Nexavar and Cabometyx (cabozantinib) with a WAC of about $21,600. Trial patients were given an average of 12.7 cycles which translates into $306,000 annually.

We have confirmed that Fotivda will launch on March 31st through limited distribution. No detail was provided as to the selected specialty pharmacy(ies).

AVEO Oncology Announces U.S. FDA Approval of Fotivda (tivozanib) for Relapsed or Refractory Advanced Renal Cell Carcinoma

FOTIVDA is the First Therapy Approved for Adult Patients with Relapsed or Refractory Advanced Renal Cell Carcinoma Following Two or More Prior Systemic Therapies

March 10, 2021 – BOSTON–(BUSINESS WIRE)–AVEO Oncology today announced that the U.S. Food and Drug Administration (FDA) has approved FOTIVDA® (tivozanib) for the treatment of adults with relapsed or refractory advanced renal cell carcinoma (RCC) who have received two or more prior systemic therapies. FOTIVDA is an oral, next-generation vascular endothelial growth factor (VEGF) tyrosine kinase inhibitor (TKI).

“Today’s approval of FOTIVDA provides a new tool for treating patients with kidney cancer who have relapsed or become refractory to two or more prior systemic therapies,” said Brian Rini, MD, Chief of Clinical Trials at Vanderbilt Ingram Cancer Center and principal investigator of the TIVO-3 trial. “With advances in RCC treatment, patients are living longer, increasing the need for proven, well tolerated treatment options in the relapsed or refractory setting. The TIVO-3 study is the first positive Phase 3 study in RCC patients who received two or more prior systemic therapies, and also the first Phase 3 RCC study to include a predefined population of patients who have received prior immunotherapy, the current standard of care in earlier-line treatment. With this approval, I believe FOTIVDA represents an attractive intervention, and expect it to play a meaningful role in the evolving RCC treatment landscape.”

“We believe in FOTIVDA’s potential to provide a differentiated treatment option for the growing number of individuals in the U.S. with relapsed or refractory RCC, and today marks the culmination of many years of hard work and determination of many individuals to bring this therapy to patients,” said Michael Bailey, president and chief executive officer of AVEO. “With today’s approval, AVEO begins its journey as a commercial-stage company, a noteworthy accomplishment in our industry. On behalf of the entire AVEO team, I would like to thank all the patients, their families, and caregivers whose tireless efforts made this day possible.”

“Relapsed or refractory RCC is a devastating disease for which patient outcomes can be limited due to the tradeoff between tolerability and efficacy,” said Dena Battle, president of KCCure. “The FDA approval of FOTIVDA represents an exciting, meaningful advancement by providing a new treatment option for this patient population.”

The approval of FOTIVDA is based on AVEO’s pivotal Phase 3 study, TIVO-3, comparing FOTIVDA to sorafenib in relapsed or refractory advanced RCC following two or more prior systemic therapies. The application is also supported by three additional trials in RCC and includes safety data from over 1,000 clinical trial subjects.

Patients (n=350) enrolled in the TIVO-3 study were randomized 1:1 to receive either FOTIVDA or sorafenib. The main efficacy outcome measure was progression-free survival (PFS), assessed by a blinded independent radiology review committee. Other efficacy endpoints were overall survival (OS) and objective response rate (ORR).

Median PFS was 5.6 months (95% CI: 4.8, 7.3) in the FOTIVDA arm (n=175) compared with 3.9 months (95% CI: 3.7, 5.6) for those treated with sorafenib (HR 0.73; 95% CI: 0.56, 0.95; p=0.016). Median OS was 16.4 (95% CI: 13.4, 21.9) and 19.2 months (95% CI: 14.9, 24.2), for the FOTIVDA and sorafenib arms, respectively (HR 0.97; 95% CI: 0.75, 1.24). The ORR was 18% (95% CI: 12%, 24%) for the FOTIVDA arm and 8% (95% CI: 4%, 13%) for the sorafenib arm.

The most common (≥20%) adverse reactions were fatigue, hypertension, diarrhea, decreased appetite, nausea, dysphonia, hypothyroidism, cough, and stomatitis. The most common grade 3 or 4 laboratory abnormalities (≥5%) were decreased sodium, increased lipase, and decreased phosphate.

The recommended tivozanib dose is 1.34 mg once daily with or without food for 21 days every 28 days on treatment followed by 7 days off treatment (28 day cycle) until disease progression or unacceptable toxicity.

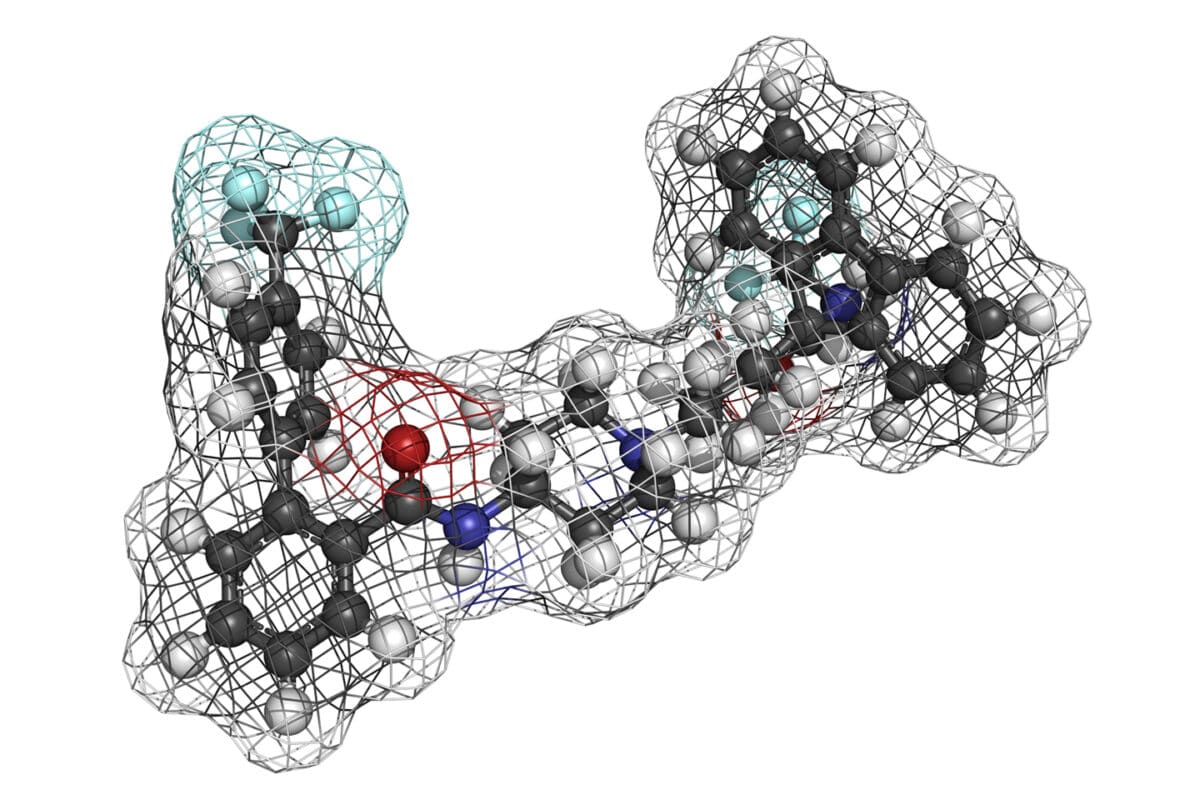

About FOTIVDA (tivozanib)

FOTIVDA (tivozanib) is an oral, next-generation vascular endothelial growth factor receptor (VEGFR) tyrosine kinase inhibitor (TKI). It is a potent, selective inhibitor of VEGFRs 1, 2, and 3 with a long half-life designed to improve efficacy and tolerability. AVEO received U.S. Food and Drug Administration (FDA) approval for FOTIVDA on March 10, 2021 for the treatment of adult patients with relapsed or refractory advanced renal cell carcinoma (RCC) following two or more prior systemic therapies. FOTIVDA was approved in August 2017 in the European Union and other countries in the territory of its partner EUSA Pharma (UK) Limited for the treatment of adult patients with advanced RCC. FOTIVDA has been shown to significantly reduce regulatory T-cell production in preclinical models1. FOTIVDA was discovered by Kyowa Kirin.