Earlier this year CVS published a sponsored article in Fierce Healthcare that raised a red flag around the concept of a specialty pharmacy carve-out.

Before we start, there may be some confusion as to what exactly is a “carve-out”. Our definition of a carve-out is to take a coverage category and treat it as a health benefit to manage on a stand-alone basis. Examples of clinical carve-outs that have delivered positive results both clinically and financially include mental health, radiology, dental, vision care…. but these benefits remain as part of the total package offered to a member.

But, some health plans have already turned to “alternate funding programs (AFPs) wherein the specialty drugs are removed from the plan Rx formulary. This essentially provides no coveragefor the specialty drugs. The payer will select a third-party company to support these now “uninsured” members and will apply for manufacturers’ patient assistance (PAP) funds to cover the cost of the prescriptions. The manufacturer ends up paying the full cost of the prescription and the pharmacy services. According to published reports, about 8% of payers have already taken this action and 30%+ are evaluating what appears to be a scam.

But let’s take a closer look at what CVS has to say.

CVS states that payers are asking themselves whether they should carve out specialty pharmacy services from the integrated pharmacy benefit management model and spotlight some of the consequences. It is unclear whether they mean ‘my’ definition of a carve-out or the APF model.

CVS says that payors are concerned with “ensuring member access to important treatments.” With so many specialty therapies launching through limited distribution one could say that a clean carve-out program (not an AFP) might be even better positioned to provide broader access.

CVS also says, “Many niche vendors (AFP vendors??) make bold claims about the results they can deliver with specialty carve-out including that it will lead to dramatic savings and enhance clinical care. Such claims are simply myths…..” But, CVS goes on to say, “In fact, our unique approach to specialty cost management can enable up to 49 percent savings on gross specialty spend.” Are such huge savings are possible without shifting a big chunk of members to uninsured status for SP??? We can’t find clarity on this claim.)

CVS says that a carve-out “involves hidden costs in the form of rebate losses and multiple vendor fees.” If anything, a unified carve-out could be better positioned to negotiate rebates. One also has to ask….. What vendor fees unless there are AFP vendors in the middle?

So, we are left with more questions than answers at this point.

—————————————————————————————————–

Multiple Specialty Vendors Mean More Headaches

Breaking down the myths about specialty carve-out — Sponsored by CVS Health

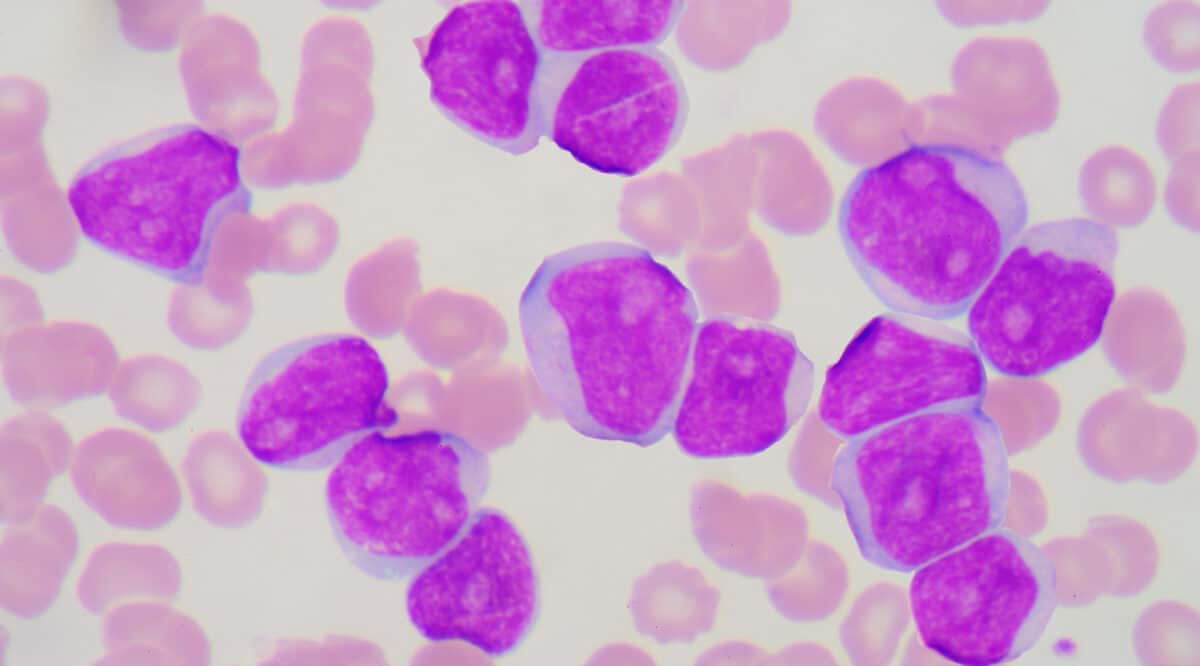

Specialty medications continue to be the biggest cost management challenge for payers, driving 54 percent of overall drug spending in 2021. The trend shows no signs of slowing and has employers and health plans looking for solutions to regain control of rising specialty pharmacy costs while ensuring member access to important treatments.

This has led to some payers asking themselves whether they should carve out specialty pharmacy services from an integrated pharmacy benefit management approach.

The question they should be asking is, “Are specialty carve-out savings too good to be true?” Many niche vendors make bold claims about the results they can deliver with specialty carve-out including that it will lead to dramatic savings and enhance clinical care. Such claims are simply myths they are perpetuating to support carving out specialty management. The reality is starkly different.

Financial Risks Outweigh the Perceived Benefits

Payers seeking tighter management of specialty drugs and greater specialty savings won’t find them by carving out. A careful analysis shows there’s no credible evidence that carve-out strategies by these niche vendors reduce net cost. Instead, two studies published in the Journal of Managed Care & Specialty Pharmacy find integrating pharmacy benefits resulted in lower medical costs and fewer hospitalizations.1,2

So, what really happens with a carved-out approach? It leads to exaggerated savings estimates that don’t take into account that treatment denials not rooted firmly in clinically rigorous decision making are likely to be overturned in the appeals process. It also involves hidden costs in the form of rebate losses and multiple vendor fees. In fact, in most cases much of the perceived “savings” are simply shifting costs from the pharmacy benefit – which has much tighter controls – to the medical benefit setting, which does not, and is often more expensive.

The Impact on Patient Care and Support

While a carved-out approach may seem like a cost-saving solution, it enables a fragmented, siloed system that jeopardizes member care – resulting in poor health outcomes and experience.

Members lose the ability to obtain needed medications easily and efficiently to effectively manage their condition. This can lead to disruption, challenge care management, and jeopardize continuity of care, and therefore worse outcomes and increased potential for adverse events.

It’s confusing and complicated for members when different vendors handle different components of the specialty pharmacy benefit. And the potential for breaks in service, therapy delays and inconsistent care grows at every step of the therapy journey. Members in plans with carved-out pharmacy benefits could lose access to connected digital tools that support their overall health and medication adherence. With so much at stake, it’s important for payers to use strategies that keep members at the center while creating cost savings.

Better Value with an Integrated Approach

A connected specialty pharmacy can deliver the consistent, personalized support that specialty patients need to stay on track. CVS Health takes an integrated approach to specialty cost management, which targets every step across the member journey, and all the components work together to deliver the most savings for payers. In fact, our unique approach to specialty cost management can enable up to 49 percent savings on gross specialty spend.

We use proven strategies and targeted solutions to deliver significant savings along with a better, cohesive member experience. We believe there’s a clear benefit to the member journey in our integrated model, which:

Helps ensure members start and stay on the most appropriate therapy

Offers the ability to better manage all prescriptions, including non-specialty medications

Engages members and their providers throughout the duration of therapy to help reduce costly, adverse events

Supports the whole patient, including comorbidities for better health outcomes

When considering which specialty management approach to adopt, the key consideration is simply whether payers want a siloed, fragmented approach or one that’s connected, and manages spend across the duration of treatment in a seamless, integrated fashion. Working with an integrated pharmacy benefit manager that supports all specialty management needs not only results in better care but also creates maximum value.

To learn more about our connected resources, and how we can help tackle your management challenges, please visit us at: https://payorsolutions.cvshealth.com/insights/power-integration.