Specialty pharmacies won’t be dispensing Abecma (idecabtagene vicleucel), approved by the FDA last week. Abecma is an INFUSED cell-based gene therapy to treat adult patients with multiple myeloma who have not responded to, or whose disease has returned after, at least four different types of therapy. Abecma is the first cell-based gene therapy for Adult Patients with Multiple Myeloma.

As you should know by now, these treatments are personalized, made up of a patient’s own immune cells extracted and shipped to processing facility. There, the cells are genetically modified to target a particular protein that acts as a flag for the cancer. The modified cells are manipulated to create a 1-time treatment dose that is shipped back to the facility for infusion.

Celgene Corporation, a Bristol Myers Squibb company, set a price of $419,500 for Abecma. Analysts believe that Abecma will be one of the top-10 sales leaders by 2025. Top 10 by 2025.

We ask this question each time a CAR T therapy is approved…..

So why should specialty pharmacies want to know about a therapy that they can’t dispense?

Simple….. more than 500 gene-based therapies are in development. That should raise a flag for specialty pharmacies. We may start seeing even the most recent generation of SP dispensed ‘wonder drugs’ replaced by 1 dose gene therapies.

SPs that work the Oncology segment should know about ALL specialty therapies in the toolbox. With more approvals of these ‘space age’ therapies such expertise is important to build credibility with patients and Oncologists.

Is this term in your pharmaceutical vocabulary?…… CAR-T.

CAR-T stands for chimeric antigen receptor T cell (CAR-T) therapy in which T-cells are extracted from a patient’s white blood cells and genetically modified in special facilities to target a specific protein that binds to cancer cells. The modified cells are then infused in the patient.

FDA Approves First Cell-Based Gene Therapy for Adult Patients with Multiple Myeloma

March 27, 2021 — The U.S. Food and Drug Administration approved Abecma (idecabtagene vicleucel), a cell-based gene therapy to treat adult patients with multiple myeloma who have not responded to, or whose disease has returned after, at least four prior lines (different types) of therapy. Abecma is the first cell-based gene therapy approved by the FDA for the treatment of multiple myeloma.

“The FDA remains committed to advancing novel treatment options for areas of unmet patient need,” said Peter Marks, M.D., Ph.D., director of the FDA’s Center for Biologics Evaluation and Research. “While there is no cure for multiple myeloma, the long-term outlook can vary based on the individual’s age and the stage of the condition at the time of diagnosis. Today’s approval provides a new treatment option for patients who have this uncommon type of cancer.”

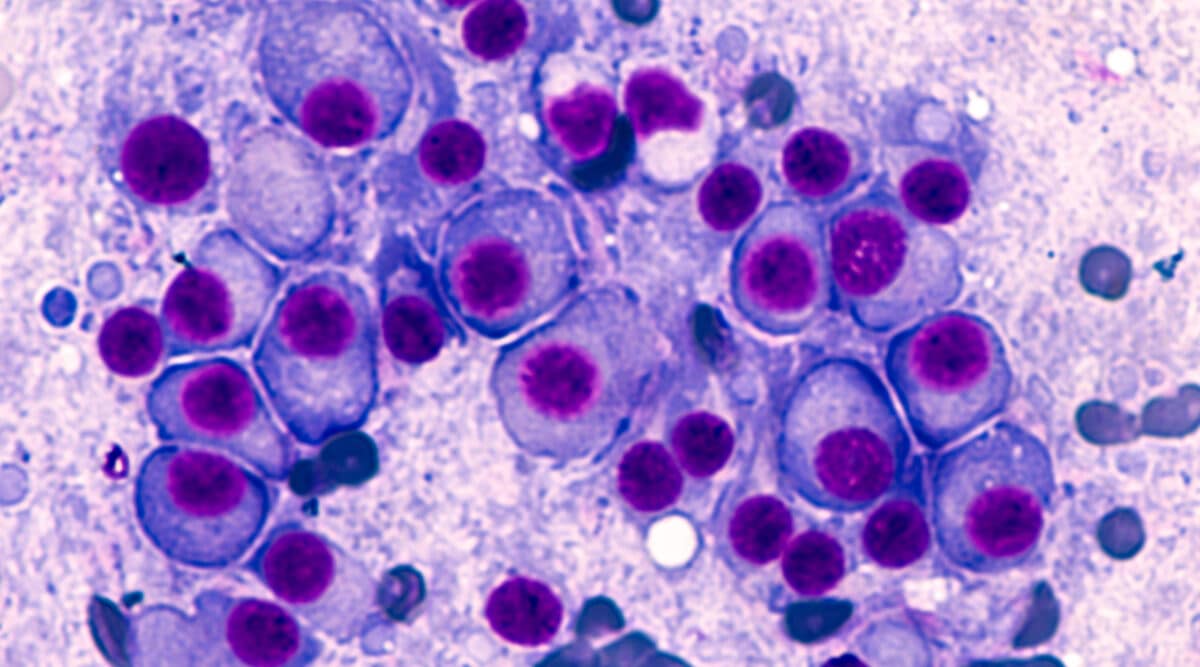

Multiple myeloma is an uncommon type of blood cancer in which abnormal plasma cells build up in the bone marrow and form tumors in many bones of the body. This disease keeps the bone marrow from making enough healthy blood cells, which can result in low blood counts. Myeloma can also damage the bones and the kidneys and weaken the immune system. The exact cause of multiple myeloma is unknown. According to the National Cancer Institute, myeloma accounted for approximately 1.8% (32,000) of all new cancer cases in the United States in 2020.

Abecma is a B-cell maturation antigen (BCMA)-directed genetically modified autologous chimeric antigen receptor (CAR) T-cell therapy. Each dose of Abecma is a customized treatment created by using a patient’s own T-cells, which are a type of white blood cell, to help fight the myeloma. The patient’s T-cells are collected and genetically modified to include a new gene that facilitates targeting and killing myeloma cells. Once the cells are modified, they are infused back into the patient.

The safety and efficacy of Abecma were established in a multicenter study of 127 patients with relapsed myeloma (myeloma that returns after completion of treatment) and refractory myeloma (myeloma that does not respond to treatment), who received at least three prior antimyeloma lines of therapy. About 88% of patients in the study group had received four or more prior lines of antimyeloma therapy. Overall, 72% of patients partially or completely responded to the treatment. Of those studied, 28% of patients showed complete response—or disappearance of all signs of multiple myeloma—to Abecma, and 65% of this group remained in complete response to the treatment for at least 12 months.

Treatment with Abecma has the potential to cause severe side effects. The label carries a boxed warning for, cytokine release syndrome (CRS), hemophagocytic lymphohistiocytosis/ macrophage activation syndrome (HLH/MAS), neurologic toxicity, and prolonged cytopenia, all of which can be fatal or life-threatening. CRS and HLH/MAS are systemic responses to the activation and proliferation of CAR-T cells causing high fever and flu-like symptoms, and prolonged cytopenia is a drop in the number of a certain blood cell type for an extended period of time. The most common side effects of Abecma include CRS, infections, fatigue, musculoskeletal pain, and a weakened immune system. Side effects from treatment usually appear within the first one to two weeks after treatment, but some side effects may occur later. Patients with multiple myeloma should consult with their health care professionals to determine whether Abecma is an appropriate treatment for them.

Because of the risk of CRS and neurologic toxicities, Abecma is being approved with a risk evaluation and mitigation strategy which includes elements to assure safe use. The FDA is requiring that hospitals and their associated clinics that dispense Abecma be specially certified and staff involved in the prescribing, dispensing or administering of Abecma are trained to recognize and manage CRS and nervous system toxicities and other side effects of Abecma. Also, patients must be informed of the potential serious side effects and of the importance of promptly returning to the treatment site if side effects develop after receiving Abecma.

To further evaluate the long-term safety, the FDA is also requiring the manufacturer to conduct a post-marketing observational study involving patients treated with Abecma.

Abecma was granted Orphan Drug and Breakthrough Therapy designations by the FDA. Orphan Drug designation provides incentives to assist and encourage the development of drugs for rare diseases. Breakthrough Therapy designation is a process designed to expedite the development and review of drugs that are intended to treat a serious condition and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over available therapy on a clinically significant endpoint(s). Breakthrough Therapy designation was granted based on sustained responses observed in patients with relapsed and refractory myeloma.

Drugs approved under expedited programs, such as Breakthrough Therapy designation, are held to the same approval standards as all other FDA approvals.

The FDA granted approval of Abecma to Celgene Corporation, a Bristol Myers Squibb company.