Last week the FDA approved a new specialty therapy for adult HIV positive patients.

Be patient, it will take some time to explain this announcement as there are several moving parts.

The new therapy is Cabenuva from ViiV.

Now pay attention…..

The biggest difference with 95% of the other HIV oral therapy options is that Cabenuva is administered monthly by intramuscular injection in the gluteus. Cabenuva is a combo therapy that includes one injection for cabotegravir and a second injection for rilpivirine, each is an extended-release injectable suspension. It is meant to be administered in the physician’s office.

But….. The FDA also approved a new ORAL form of cabotegravir called Vocabria along with ORAL rilpivirine (already approved under the brand name Edurant). Why? This one month course is taken prior to the initiation of the injectable combo therapy to ensure the medications are well-tolerated.

The new combo was made available in Europe last year and patient feedback has been surprisingly popular in spite of the fact that the therapy requires an office visit for the monthly injections. A patient survey in Europe showed that two-thirds of HIV patients were “likely” to switch to a long-acting injectable regimen. ViiV also said that feedback in the US is even higher.

Are there benefits to the injectable regimen?

Reduced pill burden. As with injectable therapies in other therapeutic categories, a once a month office injection can correct poor compliance with a daily oral therapy (often requiring multiple drugs daily). Poor compliance on HIV orals has been associated with developing drug resistance.

HIV patients are concerned with their privacy. A once a month office injection eliminates having lots of HIV pills in the medicine cabinet.

HIV patients typically see a clinician only about every 3-6 months. Seeing a clinician monthly facilitates virus level monitoring, promotes disease education, nutrition and psychological counseling, and identification of emergent concomitant medical issues.

While the FDA approval now only covers monthly use, word is that ViiV will seek approval for bimonthly administration. A big problem with HIV therapy has been missed doses, very often due to loss of insurance coverage. A two month, long-acting injectable regimen would help bridge coverage gaps.

So, will patients flock to Cabenuva ?

Uptake of this new option may most influenced by cost. Therapy will run about $4,000 per month after the induction first dose at $6,000.

How will Payers handle benefit / coverage policies — and Access for Cabenuva?

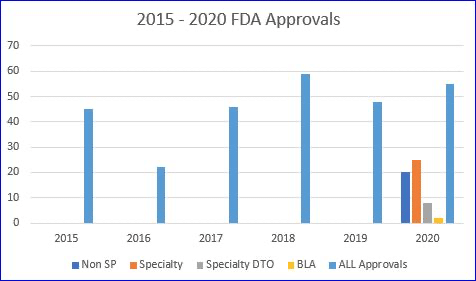

The ORAL portion of the regimen can be placed under the pharmacy benefit and would likely be available through open access like almost all HIV meds. Since the injectable schedule is office administered one would assume that Cabenuva would be obtained through wholesalers via buy-and-bill. However, given its cost and unknown demand, offices /clinics may be hesitant to stock up on the product. Precedent also shows that such injectables are increasingly placed with specialty pharmacies for limited distribution – direct-to-office (our research shows that the few previously approved HIV injectables all launched LD-DTO). We await to hear details from ViiV.

FDA approved CABENUVA (cabotegravir extended-release injectable suspension; rilpivirine extended-release injectable suspension), co-packaged for intramuscular use.

First FDA-approved injectable, complete regimen for HIV-1 infected adults that is administered once a month.

FDA also approved VOCABRIA (cabotegravir) 30 mg tablets which should be taken in combination with oral rilpivirine (EDURANT) for one month prior to starting treatment with Cabenuva to ensure the medications are well-tolerated before switching to the extended-release injectable formulation. The EDURANT (rilpivirine) tablet label was revised to reflect the oral lead-in recommendations for use with VOCABRIA.

VOCABRIA is a human immunodeficiency virus type-1 (HIV-1) integrase strand transfer inhibitor (INSTI) indicated in combination with EDURANT (rilpivirine) for short-term treatment of HIV-1 infection in adults who are virologically suppressed (HIV-1 RNA less than 50 copies/mL) on a stable antiretroviral regimen with no history of treatment failure and with no known or suspected resistance to either cabotegravir or rilpivirine, for use as:

• oral lead-in to assess the tolerability of cabotegravir prior to administration of CABENUVA (cabotegravir; rilpivirine) extended-release injectable suspensions.

• oral therapy for patients who will miss planned injection dosing with CABENUVA.

CABENUVA, a 2-drug co-packaged product of cabotegravir, a human immunodeficiency virus type-1 (HIV-1) integrase strand transfer inhibitor (INSTI), and rilpivirine, an HIV-1 non-nucleoside reverse transcriptase inhibitor (NNRTI), is indicated as a complete regimen for the treatment of HIV-1 infection in adults to replace the current antiretroviral regimen in those who are virologically suppressed (HIV-1 RNA less than 50 copies per mL) on a stable antiretroviral regimen with no history of treatment failure and with no known or suspected resistance to either cabotegravir or rilpivirine.

Dosing and Administration:

The recommended dosing is as follows:

The recommended oral lead-in daily dose is one 30-mg tablet of VOCABRIA (cabotegravir) and one 25-mg tablet of EDURANT (rilpivirine).

Intramuscular Injection Dosing with CABENUVA

Initiation Injections (CABENUVA 600-mg/900-mg Kit)

Initiate injections on the last day of oral lead-in. CABENUVA contains cabotegravir and rilpivirine extended-release injectable suspensions. The recommended initial injection doses of CABENUVA in adults are a single 600-mg (3-mL) gluteal intramuscular injection of cabotegravir and a single 900-mg (3-mL) gluteal intramuscular injection of rilpivirine. Administer cabotegravir and rilpivirine at separate gluteal injection sites (on opposite sides or 2 cm apart) during the same visit. Continuation injections should be initiated a month after the initiation injections.

Continuation Injections (CABENUVA 400-mg/600-mg Kit)

After the initiation injections, the recommended monthly continuation injection doses of CABENUVA in adults are a single 400-mg (2-mL) gluteal intramuscular injection of cabotegravir and a single 600 mg (2-mL) gluteal intramuscular injection of rilpivirine at each visit. Administer cabotegravir and rilpivirine at separate gluteal injection sites (on opposite sides or 2 cm apart) during the same visit. Patients may be given CABENUVA up to 7 days before or after the date the patient is scheduled to receive monthly injections.

Missed Injections

Adherence to the monthly injection dosing schedule is strongly recommended. Patients who miss a scheduled injection visit should be clinically reassessed to ensure resumption of therapy remains appropriate.

Planned Missed Injections (Oral Dosing to Replace Up to 2 Consecutive Monthly Injections)

If a patient plans to miss a scheduled injection visit by more than 7 days, take daily oral therapy to replace up to 2 consecutive monthly injection visits. The recommended oral daily dose is one 30-mg tablet of VOCABRIA (cabotegravir) and one 25-mg tablet of EDURANT (rilpivirine). The first dose of oral therapy should be taken approximately 1 month after the last injection dose of CABENUVA and continued until the day injection dosing is restarted.

Unplanned Missed Injections

If monthly injections are missed or delayed by more than 7 days and oral therapy has not been taken in the interim, clinically reassess the patient to determine if resumption of injection dosing remains appropriate

Injection Dosing Recommendations after Missed Injections

Less than or equal to 2 months since last injection:

Resume with 400-mg (2-mL) cabotegravir and 600-mg (2-mL) rilpivirine intramuscular monthly injections as soon as possible.

Greater than 2 months since last injection:

Re-initiate the patient with 600-mg (3-mL) cabotegravir and 900-mg (3 mL) rilpivirine intramuscular injections then continue to follow the 400 mg (2 mL) cabotegravir and 600-mg (2-mL) rilpivirine intramuscular monthly injection dosing schedule

Summary of Clinical Studies:

The efficacy of CABENUVA has been evaluated in two Phase 3 randomized, multicenter, active-controlled, parallel-arm, open-label, non-inferiority trials:

• Trial 201584 (FLAIR, [NCT02938520]), (n = 629): HIV-1–infected, antiretroviral treatment (ART)-naive subjects received a dolutegravir INSTI-containing regimen for 20 weeks (either dolutegravir/abacavir/lamivudine or dolutegravir plus 2 other NRTIs if subjects were HLA-B*5701 positive). Subjects who were virologically suppressed (HIV-1 RNA less than 50 copies/mL, n = 566) were then randomized (1:1) to receive either a cabotegravir plus rilpivirine regimen or remain on the current antiretroviral regimen. Subjects randomized to receive cabotegravir plus rilpivirine initiated treatment with daily oral lead-in dosing with one 30-mg VOCABRIA (cabotegravir) tablet plus one 25-mg EDURANT (rilpivirine) tablet for at least 4 weeks followed by monthly injections with CABENUVA for an additional 44 weeks.

• Trial 201585 (ATLAS, [NCT02951052]), (n = 616): HIV-1–infected, ART-experienced, virologically-suppressed (for at least 6 months; median prior treatment duration was 4.3 years) subjects (HIV-1 RNA less than 50 copies/mL) were randomized and received either a cabotegravir plus rilpivirine regimen or remained on their current antiretroviral regimen. Subjects randomized to receive cabotegravir plus rilpivirine initiated treatment with daily oral lead-in dosing with one 30-mg VOCABRIA (cabotegravir) tablet plus one 25-mg EDURANT (rilpivirine) tablet for at least 4 weeks followed by monthly injections with CABENUVA for an additional 44 weeks.

The primary analysis was conducted after all subjects completed their Week 48 visit or discontinued the trial prematurely.

The primary endpoint of FLAIR and ATLAS was the proportion of subjects with plasma HIV-1 RNA greater than or equal to 50 copies/mL at Week 48.

Adverse Reactions:

The safety assessment of CABENUVA is based on the analysis of pooled 48-week data from 1,182 virologically suppressed subjects with HIV-1 infection in 2 international, multicenter, open-label pivotal trials, FLAIR and ATLAS.

The most common adverse reactions (Grades 1 to 4) observed in ≥2% of subjects receiving CABENUVA were injection site reactions, pyrexia, fatigue, headache, musculoskeletal pain, nausea, sleep disorders, dizziness, and rash.

Injection-Associated Adverse Reactions

Local Injection Site Reactions (ISRs): The most frequent adverse reactions associated with the intramuscular administration of CABENUVA were ISRs. After 14,682 injections, 3,663 ISRs were reported. One percent (1%) of subjects discontinued treatment with CABENUVA because of ISRs. Most ISRs were mild (Grade 1, 75%) or moderate (Grade 2, 36%). Four percent (4%) of subjects experienced severe (Grade 3) ISRs, and no subjects experienced Grade 4 ISRs.